Imagine this: you’re sipping coffee on a quiet morning, checking your bank account, and seeing money roll in—without lifting a finger. That’s the dream of passive income, and it’s closer than you think. If you’re new to investing or just tired of chasing volatile trends, the best dividend stocks to buy and hold could be your ticket to steady, reliable wealth.

Dividend stocks, in particular, offer a way to earn consistent cash while letting your investments grow over time. But where do you start? Don’t worry—I’ve got you covered with this beginner-friendly guide.

We’ll explore what makes a stock worth holding forever, spotlight the top 25 picks, and show you how to turn your money into a passive income machine.

Why Dividend Stocks Are the Best Stocks to Buy and Hold

Let’s cut to the chase: the best dividend stocks to buy and hold aren’t flashy tech startups or risky gambles—they’re often steady, dividend-paying companies that reward you for sticking around. Unlike growth stocks that promise big gains but no income, dividend stocks pay you regularly—think of it as a thank-you note from the company.

Over time, these payments can snowball into serious cash flow, whether you’re aiming for $500 a month in dividends or dreaming of how to make $1,000 a month in dividends.

Here’s the kicker: data backs this up. According to a Hartford Funds report, from 1940–2024, dividend income’s contribution to the total return of the S&P 500 Index averaged 34%.

additionally, dividend stocks were found to be less volatile. That’s stability and growth—perfect for beginners wondering, “What is the best passive income for beginners?”

What Makes a Stock a “Buy and Hold” Winner?

Before we dive into the top 25 dividend stocks to buy and hold, let’s break down what separates the best dividend stocks to buy and hold from the rest. It’s not just about high yields—sustainability matters too. Here’s what to look for:

- Consistent Dividend Growth: Companies that raise dividends yearly (like Dividend Aristocrats—firms with 25+ years of increases) signal strength.

- Reasonable Payout Ratio: Aim for 50-60% of earnings paid as dividends. Above 100%? Red flag—it’s unsustainable.

- Strong Cash Flow: Cash-rich companies can weather storms and keep paying you.

- Low Volatility: You want steady performers, not rollercoasters.

Think of it like picking a reliable car: flashy might catch your eye, but you’ll stick with the one that runs smoothly for years.

The 25 Best Dividend Stocks to Buy and Hold Forever

Here’s the main event: a curated list of the best stocks to buy and hold, blending high yields, growth potential, and rock-solid reliability. These are your monthly dividend stocks to hold forever, your highest dividend-paying stocks in the world, and your ticket to passive income. (Note: Prices and yields are approximate at the time of writing this article—always double-check before investing!)

High-Yield Heavyweights

1. Realty Income (O)

Annual divided yield: 5.69%

Stock price: $56.61 USD

Why: Known as “The Monthly Dividend Company,” this REIT pays monthly and has raised dividends for 30+ years. Perfect for highest paying monthly dividend stocks.

Tip: Start here if you’re asking, “What is the best dividend stock for passive income?”

2. AGNC Investment Corp (AGNC)

Annual dividend yield: 15.13%

Stock price: $ 9.78 USD

| Open | 9.78 |

| High | 9.78 |

| Low | 9.49 |

| Mkt cap | 8.72B |

| P/E ratio | 10.24 |

| Div yield | 15.13% |

| 52-wk high | 10.85 |

| 52-wk low | 8.92 |

Why: A mortgage REIT with juicy monthly payouts. Riskier, but a passive income champ.

Tip: Pair with safer picks to balance your portfolio.

3. Oxford Square Capital (OXSQ)

Annual dividend yield: 16.41%

Stock price: $2.56 USD

| Open | 2.56 |

| High | 2.58 |

| Low | 2.54 |

| Mkt cap | 178.66M |

| P/E ratio | 27.63 |

| Div yield | 16.41% |

| 52-wk high | 3.29 |

| 52-wk low | 2.40 |

Why: A business development company (BDC) offering sky-high monthly dividends.

Tip: Ideal for aggressive investors chasing top 25 highest dividend-paying stocks in the world.

4. Walgreens Boots Alliance (WBA)

Annual dividend yield: 8.96%

Stock price: $11.19

Why: A retail pharmacy giant with a hefty yield despite recent struggles. Dividend Aristocrat status adds credibility.

Tip: Watch earnings to ensure payout stability.

5. Altria Group (MO)

Annual dividend yield: 7.02%

Stock price: $58.50 USD

| Open | 58.50 |

| High | 58.56 |

| Low | 57.76 |

| Mkt cap | 98.31B |

| P/E ratio | 8.89 |

| Div yield | 7.02% |

| 52-wk high | 59.67 |

| 52-wk low | 40.65 |

Why: Tobacco king with a monster yield and 50+ years of dividend hikes.

Tip: A staple for best dividend stocks of all time.

How the Rich Make Money: Secrets from the World’s Top Billionaires

Dividend Growth Giants

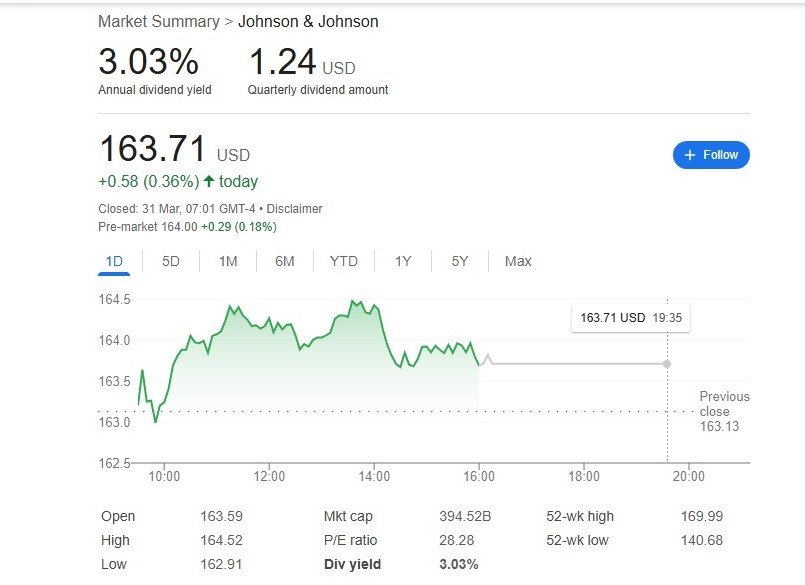

6. Johnson & Johnson (JNJ)

Annual dividend yield: 3.03%

Price: $163.71 USD

| Open | 163.59 |

| High | 164.52 |

| Low | 162.91 |

| Mkt cap | 394.52B |

| P/E ratio | 28.28 |

| Div yield | 3.03% |

| 52-wk high | 169.99 |

| 52-wk low | 140.68 |

Why: 60+ years of dividend increases. Healthcare’s gold standard.

Tip: Great for beginners seeking best dividend stocks for passive income.

7. Procter & Gamble (PG)

Yield: 2.40%

Price: $168.03 USD

| Open | 169.38 |

| High | 169.71 |

| Low | 167.62 |

| Mkt cap | 394.01B |

| P/E ratio | 26.77 |

| Div yield | 2.40% |

| 52-wk high | 180.43 |

| 52-wk low | 153.52 |

Why: Household goods titan with 68 years of raises. Recession-proof.

Tip: Reinvest dividends for long-term magic.

8. Coca-Cola (KO)

Annual dividend yield: 2.90%

Price: $70.37 USD

| Open | 70.81 |

| High | 71.32 |

| Low | 69.53 |

| Mkt cap | 302.84B |

| P/E ratio | 28.60 |

| Div yield | 2.90% |

| 52-wk high | 73.53 |

| 52-wk low | 57.93 |

Why: 62 years of dividend growth and a global brand. Sweet and steady.

Tip: A classic in any top 25 dividend stocks list.

9. Chevron (CVX)

Annual dividend yield: 4.12%

Stock price: $166.09 USD

| Open | 166.70 |

| High | 167.13 |

| Low | 165.30 |

| Mkt cap | 292.42B |

| P/E ratio | 17.09 |

| Div yield | 4.12% |

| 52-wk high | 168.96 |

| 52-wk low | 135.37 |

Why: Energy giant with 38 years of payout hikes. Loves oil bulls.

Tip: Diversify with this for energy exposure.

10. ExxonMobil (XOM)

Annual dividend yield: 3.36%

Stock price: $117.73 USD

| Open | 118.10 |

| High | 118.46 |

| Low | 117.24 |

| Mkt cap | 510.85B |

| P/E ratio | 15.04 |

| Div yield | 3.36% |

| 52-wk high | 126.34 |

| 52-wk low | 103.67 |

Why: Another oil titan with 40+ years of increases. Trades 20% below fair value (Morningstar, 2025).

Tip: A must for best stocks to buy and hold.

Monthly Dividend Darlings

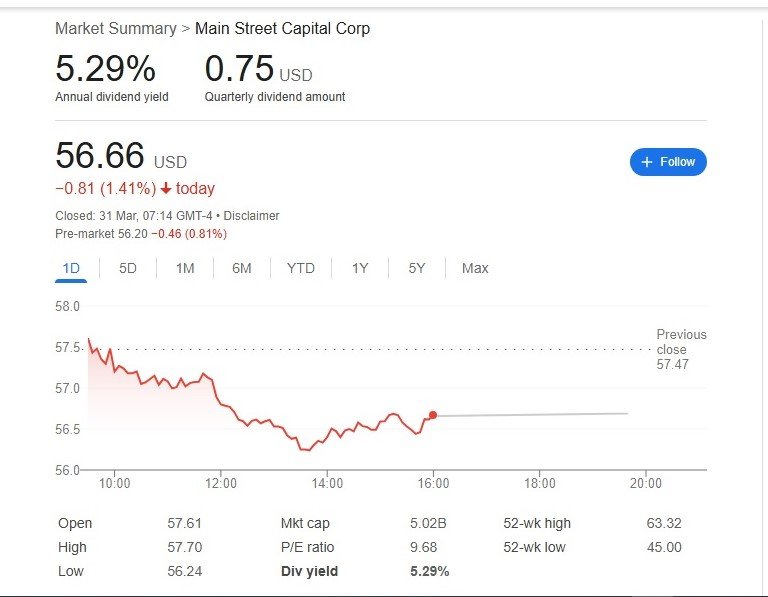

11. Main Street Capital (MAIN)

Annual dividend yield: 5.29%

Stock price: $56.66

Why: A BDC paying monthly dividends with a focus on small businesses.

Tip: Check out monthly dividend stocks list fans—this one’s a gem.

12. Stag Industrial (STAG)

Annual dividend yield: 4.19%

Stock price: $35.59

| Open | 35.62 |

| High | 35.71 |

| Low | 35.27 |

| Mkt cap | 6.64B |

| P/E ratio | 34.34 |

| Div yield | 4.19% |

| 52-wk high | 41.63 |

| 52-wk low | 32.27 |

Why: Industrial REIT with monthly payouts and e-commerce tailwinds.

Tip: Affordable at under $40—great for best monthly dividend stocks under $20.

13. EPR Properties (EPR)

Annual dividend yield: 6.85%

Stock price: $51.70

| Open | 51.58 |

| High | 51.75 |

| Low | 50.88 |

| Mkt cap | 3.93B |

| P/E ratio | 32.23 |

| Div yield | 6.85% |

| 52-wk high | 54.25 |

| 52-wk low | 39.66 |

Why: Monthly dividends from entertainment and leisure properties.

Tip: Riskier but rewarding for income seekers.

14. LTC Properties (LTC)

Annual dividend yield: 6.47%

Stock price: $35.25

| Open | 35.12 |

| High | 35.27 |

| Low | 34.87 |

| Mkt cap | 1.60B |

| P/E ratio | 17.26 |

| Div yield | 6.47% |

| 52-wk high | 39.89 |

| 52-wk low | 31.14 |

Why: Healthcare REIT with monthly dividends and an aging population boost.

Tip: A sleeper hit for how to generate $1,000 a month in dividends.

15. Gladstone Investment (GAIN)

Annual dividend yield: 7.06%

Stock price: $13.60

| Open | 13.60 |

| High | 13.68 |

| Low | 13.57 |

| Mkt cap | 500.99M |

| P/E ratio | 7.09 |

| Div yield | 7.06% |

| 52-wk high | 14.85 |

| 52-wk low | 12.46 |

Why: Monthly dividends from a BDC with a knack for private equity.

Tip: High yield, high potential.

Undervalued Gems

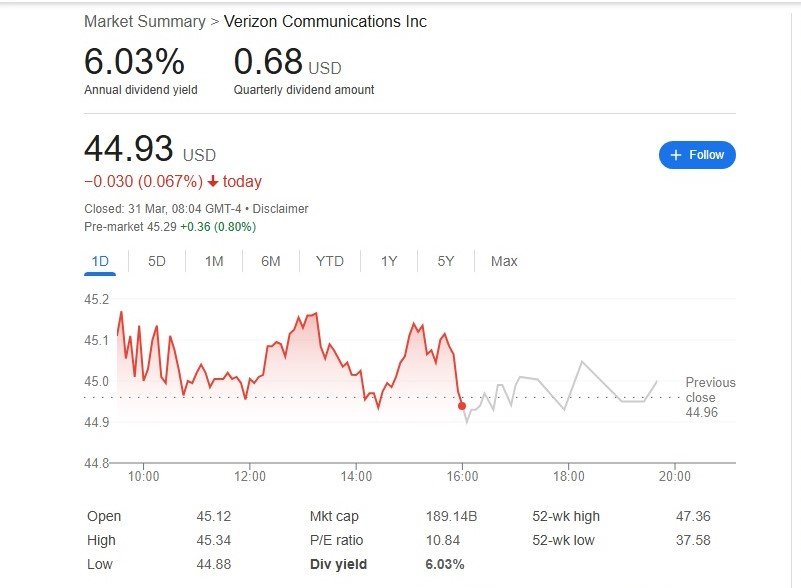

16. Verizon Communications (VZ)

Annual dividend yield: 6.03%

Stock price: $44.93

Why: Telecom titan with a fat yield and 5G growth ahead.

Tip: A no-brainer for best stocks to buy.

17. Pfizer (PFE)

Annual dividend yield: 6.82%

Stock price: $25.21

| Open | 25.03 |

| High | 25.22 |

| Low | 24.81 |

| Mkt cap | 142.98B |

| P/E ratio | 17.92 |

| Div yield | 6.82% |

| 52-wk high | 31.54 |

| 52-wk low | 24.48 |

Why: Pharma leader with a solid payout and pipeline potential.

Tip: Undervalued and income-friendly.

18. LyondellBasell Industries (LYB)

Annual dividend yield: 7.68%

Stock price: $69.82

| Open | 70.90 |

| High | 71.32 |

| Low | 69.74 |

| Mkt cap | 22.58B |

| P/E ratio | 16.86 |

| Div yield | 7.68% |

| 52-wk high | 107.02 |

| 52-wk low | 69.74 |

Why: Chemicals giant trading 36% below fair value (Morningstar, 2025).

Tip: A hidden star among highest dividend-paying stocks in the world.

19. Southern Company (SO)

Annual dividend yield: 3.16%

Stock price: $91.13

| Open | 90.88 |

| High | 91.44 |

| Low | 90.27 |

| Mkt cap | 99.95B |

| P/E ratio | 22.82 |

| Div yield | 3.16% |

| 52-wk high | 94.45 |

| 52-wk low | 67.53 |

Why: Utility powerhouse serving 9 million customers with growing demand.

Tip: Safe and steady for beginners.

20. NextEra Energy (NEE)

Annual dividend yield: 3.22%

Stock price: $70.45

| Open | 70.44 |

| High | 70.98 |

| Low | 70.17 |

| Mkt cap | 144.87B |

| P/E ratio | 20.89 |

| Div yield | 3.22% |

| 52-wk high | 86.10 |

| 52-wk low | 61.31 |

Why: Top U.S. utility with renewable energy upside.

Tip: Future-proof your portfolio.

Bonus Picks for Diversification

21. PepsiCo (PEP)

Annual dividend yield: 3.63%

Stock price: $149.27

Why: Snacks and drinks with 50+ years of dividend growth.

Tip: Pairs well with Coca-Cola.

22. IBM (IBM)

Annual dividend yield: 2.74%

Stock price: $244.00

| Open | 246.27 |

| High | 247.57 |

| Low | 242.07 |

| Mkt cap | 226.25B |

| P/E ratio | 35.34 |

| Div yield | 2.74% |

| 52-wk high | 266.45 |

| 52-wk low | 162.62 |

Why: Tech veteran pivoting to cloud and AI with a decent yield.

Tip: A tech twist on best dividend stocks to buy and hold.

23. 3M (MMM)

Annual dividend yield: 2.02%

Stock price: $144.84

| Open | 147.86 |

| High | 148.85 |

| Low | 144.33 |

| Mkt cap | 78.11B |

| P/E ratio | 19.96 |

| Div yield | 2.02% |

| 52-wk high | 156.35 |

| 52-wk low | 87.45 |

Why: Industrial icon with 60+ years of payout increases.

Tip: Recent challenges, but a rebound candidate.

24. Merck (MRK)

Annual dividend yield: 3.63%

Stock price: $89.23

| Open | 88.20 |

| High | 90.14 |

| Low | 87.67 |

| Mkt cap | 225.40B |

| P/E ratio | 13.25 |

| Div yield | 3.63% |

| 52-wk high | 134.63 |

| 52-wk low | 81.04 |

Why: Pharma giant with a strong drug pipeline.

Tip: Trades 16% below fair value (Morningstar, 2025).

25. Schlumberger (SLB)

Annual dividend yield: 2.72%

Stock price: $41.88

| Open | 42.15 |

| High | 42.55 |

| Low | 41.49 |

| Mkt cap | 56.95B |

| P/E ratio | 13.48 |

| Div yield | 2.72% |

| 52-wk high | 55.65 |

| 52-wk low | 36.52 |

Why: Oilfield services leader with a narrow moat and shareholder-friendly payouts.

Tip: Rounds out your top 25 dividend stocks.

How to Start Investing in the Best Dividend Stocks to Buy and Hold

Ready to jump in? Here’s your step-by-step playbook to turn these best dividend stocks to buy and hold into your personal cash machine.

Step 1: Open a Brokerage Account

- Pick a beginner-friendly platform like Robinhood (commission-free) or Fidelity (great research tools).

- Fund it with whatever you can—$100, $500, or more.

Step 2: Set Your Income Goal

- Want $500 a month in dividends? At a 4% yield, you’ll need $150,000 invested.

- Aiming for how to make $1,000 a month in dividends? That’s $300,000 at 4%. Start small and build up.

Step 3: Pick Your Stocks

- Use a stock screener to filter for yield (e.g., 3-6%) and dividend history (10+ years).

- Mix high-yield (Realty Income) with growth (JNJ) and monthly payers (MAIN).

Step 4: Reinvest Dividends

- Enroll in a DRIP (Dividend Reinvestment Plan) to buy more shares automatically.

- Example: $100 in dividends at $50/share = 2 extra shares. Compounding kicks in fast.

Step 5: Diversify and Monitor

- Spread your cash across 10-15 stocks in different sectors (energy, healthcare, REITs).

- Check quarterly earnings to ensure dividends stay safe.

Learn more on how to buy your first stock

How Much Can You Really Make?

Let’s get practical. Say you invest $10,000 across these best dividend stocks for passive income with an average 4% yield:

- Annual dividends = $400

- Monthly = $33

Not life-changing, but reinvest that $400 yearly, and with 7% average returns (dividends + growth), you’d have $32,000 in 20 years. Bump your starting point to $50,000? You’re at $162,000—enough for $500 a month in dividends at 4%. The key? Patience and consistency.

For how to generate $1,000 a month in dividends, you’d need $300,000 at 4%. Sound daunting? Start with $500 monthly investments. In 20 years at 7% returns, you’re there. That’s the power of the best stocks to buy and hold.

ALSO READ:

How to Spot a Crypto Scam in 10 Seconds: Your Foolproof Guide

Buy XRP Crypto Now at Only $2 or Cry Later

Growth vs. Dividend Stocks: Which is Better?

| Feature | Growth Stocks (e.g., Tesla) | Dividend Stocks (e.g., Coca-Cola) |

|---|---|---|

| Returns | Higher, but volatile | Steady and reliable |

| Risk Level | High | Low to Medium |

| Passive Income | No | Yes (Regular payouts) |

| Best For | Long-term capital gains | Stable, income-focused investors |

Pro Tip: A mix of both can provide a balanced portfolio!

Tips to Maximize Your Dividend Portfolio

Want to supercharge your returns? Here’s how:

- Focus on Dividend Aristocrats: Stocks like KO and PG have decades of reliability.

- Mix Monthly and Quarterly Payers: Smooth out cash flow with STAG and O alongside CVX.

- Avoid Yield Traps: A 15% yield might mean a dividend cut’s coming—check payout ratios.

- Stay Tax-Savvy: Hold in a Roth IRA to keep dividends tax-free.

- Be Patient: The best dividend stocks of all time shine over decades, not months.

Conclusion: Start Building Your Wealth Today

The best stocks to buy and hold aren’t just investments—they’re your partners in financial freedom. Whether you’re chasing $1,000 a month in dividends, dipping your toes with best monthly dividend stocks under $20, or building a fortress of top 25 dividend stocks, this guide gives you the roadmap. Start small, pick a few from our list—like JNJ, Realty Income, or Verizon—and let time do the heavy lifting. Stay informed, reinvest those dividends, and watch your passive income grow.

Ready to start? Pick 3-5 stocks from this list, invest consistently, and watch your passive income grow!

Did we miss any of your favorite dividend stocks? Let us know in the comments!

FAQs: Best Dividend Stocks to Buy and Hold Forever

Find answers to some of the most common questions on the best dividend stocks to buy and hold