President Trump’s 34% tariff bomb on Chinese imports didn’t just ignite another trade conflict—it sent a tremor through the crypto markets that’s still shaking portfolios. Bitcoin, the so-called “digital gold,” initially tanked alongside stocks. But now, a critical question looms: Can Bitcoin survive Trump Tariffs?

Is Bitcoin about to collapse as collateral damage—or will it emerge as the ultimate winner of this trade war?

Table of Contents

The Shockwave: How China Got Hit

At midnight on April 9, the U.S. will apply an enhanced 34% total tariff on all Chinese goods—a brutal escalation from the previous 20%.

Expected Beijing’s response? A mix of fury and strategic retaliation:

- Targeted bans on U.S. tech firms (Apple, Tesla, Intel)

- Dumping U.S. Treasuries to weaken the dollar

- Flooding markets with cheap solar panels and EVs to undercut American green energy

The immediate market reaction? Chaos.

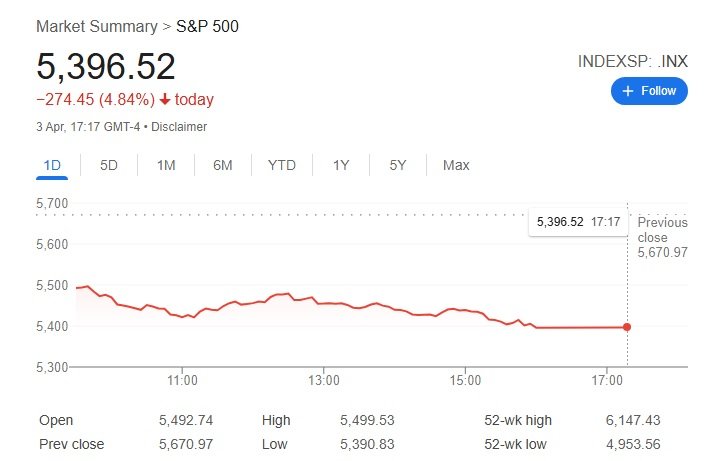

- According to CNBC, S&P 500 dropped 1600 points.

- Gold surged to $2,500/oz as panic set in

- Bitcoin briefly plunged below $82K before clawing back

But here’s the twist: This time, Bitcoin’s reaction is different.

Bitcoin’s Identity Crisis: Hedge or Risk Asset?

In 2018, during the first U.S.-China trade war, Bitcoin crashed 50% alongside stocks. Today, the script is flipping.

Why? Three reasons:

- The Dollar’s Slow-Motion Crisis

- China’s Treasury dump threatens the petrodollar system

- Emerging markets are ditching USD reserves faster than ever

- Bitcoin, with no central bank, looks increasingly like a lifeboat

- Capital Flight Goes Crypto

- Chinese investors, facing stricter capital controls, are funneling money into BTC overpasses (HK brokers, OTC desks)

- Tether (USDT) trading volume in CNY pairs spiked 66.62% in 48 hours

- Inflation’s Shadow Looms

- Tariffs = higher prices = stagflation risk

- Bitcoin’s hard cap of 21 million makes it the ultimate anti-inflation play

RELATED:

Trump’s Liberation Day Tariffs: A Genius Move or Economic Suicide?

CRYPTO CRASH: How Trump Tariffs Obliterated $487M in 24 Hours

The Contrarian Case: Why Bitcoin Could Still Crash

Not everyone’s convinced. The bears point to:

- Liquidation cascades (over $600M in futures wiped out)

- Crypto’s correlation with tech stocks (still too high for comfort)

- China’s potential crypto crackdown (they’ve done it before)

If Beijing bans Bitcoin mining (again) or restricts exchanges, another flash crash to $70K isn’t off the table.

The Verdict: Can Bitcoin Survive?

History shows that geopolitical chaos accelerates Bitcoin adoption:

- 2013 Cyprus crisis → BTC 10x

- 2020 COVID crash → BTC 7x

- 2022 Russia sanctions → BTC as “neutral” money

Now, with Trade War 2.0 raging, the stage is set for either:

A) A temporary crash (buy the dip)

B) A historic breakout (BTC $150K by 2026)

One thing’s certain: The rules of global finance are being rewritten in real time—and Bitcoin’s role is still being decided.