The crypto market just got nuked. Crypto crash!

In a single day, half a billion dollars ($487M) vanished from digital asset markets. Bitcoin plunged. Ethereum collapsed. Altcoins were slaughtered. And the bloodbath isn’t over yet.

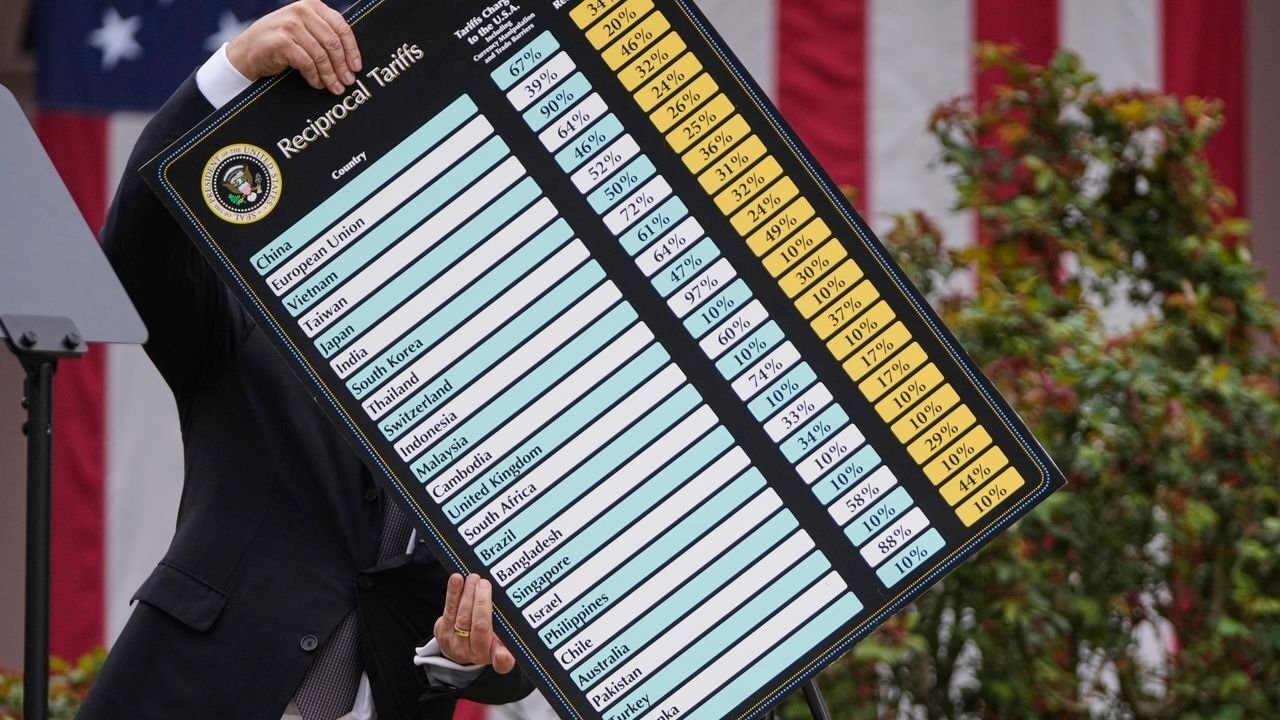

The trigger? President Trump’s “Liberation Day” tariffs—a brutal economic shockwave that sent traders scrambling for the exits.

This is the story of how one executive order ignited a financial wildfire—and why the worst may still be coming.

Table of Contents

The Massacre: By the Numbers

when were trump tariffs announced? Well, on February 2, 2025, the world witnessed one of the brutal global trade war—announcement of Reciprocal Tariffs (Liberation Day Tariffs or simply Trump Tariffs).

And here is break down of the carnage caused:

- Bitcoin (BTC): Down 7.47% ($87,869.95 0n April 2, 2025–before→$84,812.2→$81,302.41 on April 3, 2025)

- Ethereum (ETH): Down 8.81% ($1933.07 on April 2, 2025–before→$1785.37→$1762.74)

- Solana (SOL): Down 16.82% ($135.41→$117.71→$112.64)

- Total Liquidations: $487M in 24 hours (X/@andreswifitv)

- Worst Hit Altcoins: PI (-33%), Ethena (-18%), Celestia (-22%)

This wasn’t a “normal correction.” This was panic selling at scale—and it all traces back to Washington.

ALSO READ:

Trump’s Liberation Day Tariffs: A Genius Move or Economic Suicide?

The Trigger: Trump’s Tariff Bomb

At 12:01 AM on April 5, every import entering the U.S. will be hit with a 10% tax. No warnings. No phase-ins. Just a financial grenade lobbed into global markets.

The immediate reaction? Risk-off mode.

Why Crypto Got Crushed

- Inflation Fears → Fed Uncertainty

- Tariffs = higher prices = stronger inflation.

- Traders now betting Fed won’t cut rates in June.

- Result: Dump speculative assets (like crypto).

- Liquidity Crisis

- Hedge funds yanked capital to cover losses elsewhere.

- Overleveraged traders got wiped out in cascading liquidations.

- Stock Market Contagion

- According WSJ, Trump Tariffs sent Dow to 1600-point decline

- S&P 500 dropped 4.8% same day.

- All major stock indices dropped by 6.0%

- Crypto now moves in lockstep with equities (thanks, ETFs).

The Liquidations: How $487M Evaporated

Leverage kills. And on April 2, 2025, it massacred crypto traders.

The Domino Effect

- BTC dipped below $82K → Stop losses triggered.

- ETH broke $2000 run → More panic selling.

- Altcoins (low liquidity) got slaughtered → -20% in hours.

The biggest casualties?

- A whale lost $28M on a SOL long (Binance).

- $76M in BTC positions liquidated on Bybit.

- Meme coins (PEPE, WIF) dropped 10%+.

This wasn’t just “paper hands.” This was systemic deleveraging.

The Hidden Casualty: Crypto Stocks

Crypto isn’t just coins—it’s public companies. And they got wrecked:

- Coinbase (COIN): -7.7%

- MicroStrategy (MSTR): -9.1%

- Marathon Digital (MARA): -12.3%

Why? Because crypto stocks are 3x more volatile than Bitcoin itself.

What’s Next? Three Scenarios

1. Dead Cat Bounce (Likely Short-Term)

- Markets oversold → quick rebound to $102K BTC.

- But tariff uncertainty lingers → new downtrend possible.

2. Full-Blown Crypto Winter (If Tariffs Escalate)

- China/EU retaliation → global recession fears → BTC $70K.

- Altcoins could drop another 40%.

3. The Ultimate Irony: Bitcoin as Safe Haven (Long Shot)

- If tariffs crash the dollar, BTC could moon as hedge.

- But not yet. First, more pain.

Discover Top 8 Things You Need to Consider Before Investing

The Bottom Line

Trump’s tariffs didn’t just shake traditional markets—they exposed crypto’s fragility.

The $487M wipeout proves one thing: Crypto isn’t decoupled from macro. Not even close.

And if trade wars escalate? Buckle up. The real storm may just be starting.

Want the next crypto crash alert before it happens?

[Subscribe Now] – Or miss the next 50% drop.