Fartcoin (FARTCOIN) posted a strong performance today, rallying 9.07% to trade at $0.9104 as of press time. The meme-inspired cryptocurrency has captured investor attention following a sharp uptick in trading activity and renewed market momentum.

The 24-hour trading volume for Fartcoin hit $327.17 million, representing a 21.86% increase. This surge in volume pushed its volume-to-market cap ratio to an impressive 35.91%, signaling heightened liquidity and active market participation.

The market capitalization now stands at $912.39 million, with a fully diluted valuation (FDV) of $911.48 million, indicating minimal difference between current and potential total market value — a sign of high circulation and limited inflation risk.

Fartcoin’s circulating supply is near maximum capacity, with 999.99 million tokens in circulation out of a total supply of 1 billion. This near-complete distribution reflects strong adoption and positions the asset favorably against inflationary dilution.

Fartcoin Price Elicits Bullish Sentiments

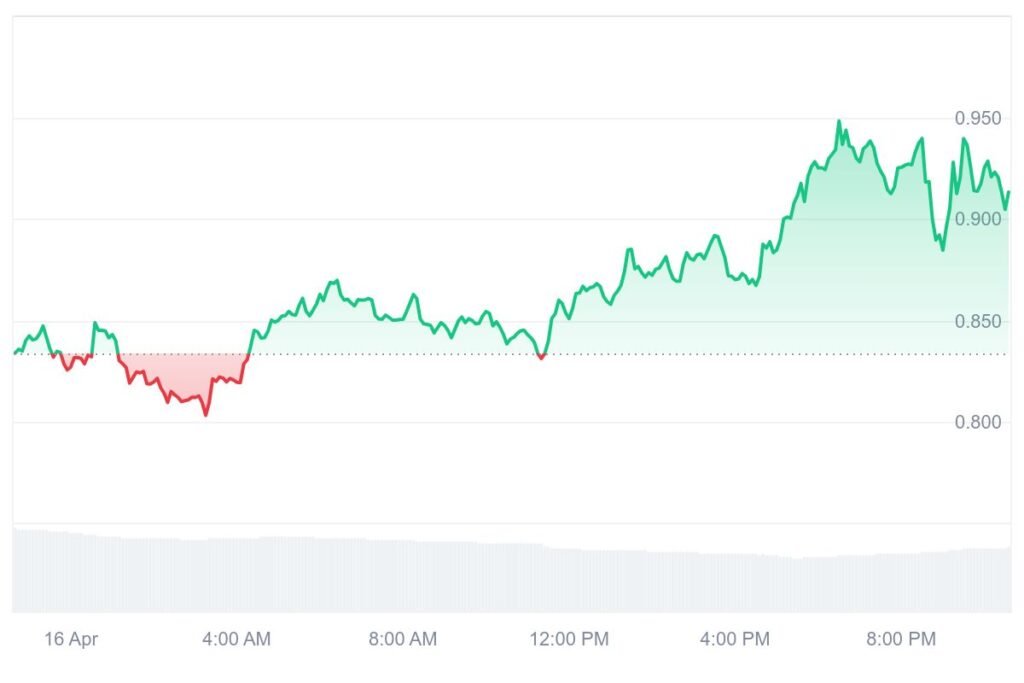

The price chart for April 16 shows early-day volatility, with Fartcoin dipping to around $0.834 before initiating a steady recovery. The token peaked at $0.950 late in the trading day, underscoring bullish sentiment before correcting slightly to the current price range.

Ranked #65 on CoinMarketCap and closely tracked by over 66,000 watchers, Fartcoin’s recent movement aligns with broader speculative interest in high-liquidity altcoins. Analysts suggest the sharp rise may be linked to strategic whale movements or renewed interest in meme assets amid a cooling of major altcoin momentum.

Investors are advised to watch Fartcoin’s price action closely over the next 24–48 hours, as sustained volume above $300M may indicate continuation or a short-term breakout. With its supply nearly maxed out and market cap nearing the billion-dollar mark, Fartcoin is fast becoming more than a meme — it’s a speculative force in the altcoin landscape.

FURTHER READING:

Fartcoin Price Surges Over 9% as Trading Volume Soars Past $327M

OM MANTRA Coin Crash: What Really Happened and Why Investors Should Pay Close Attention