The cryptocurrency world is full of opportunity—but it’s also crawling with traps. One of the most devastating scams you can face is the rug pull. It’s when a crypto project attracts investors, hypes up its token, collects liquidity, and then the developers vanish—along with your money.

If you’re new to the crypto space, this guide is your no-fluff, practical checklist to avoid crypto rug pulls in 2025. These aren’t recycled tips—they’re actionable steps that serious investors follow to protect their funds.

Table of Contents

What Is a Rug Pull?

A rug pull is a type of scam in the cryptocurrency world where the people behind a project suddenly disappear—usually after draining all the money out of the system. Think of it like investing in a new online startup only to find that the founders vanished overnight, taking all the funds with them. The term comes from the idea of pulling the rug out from under someone—catching them off guard and leaving them with nothing.

Crypto Rug pulls are especially common in decentralized finance (DeFi). This part of the crypto space is built on smart contracts, which are self-executing programs that live on blockchains like Ethereum.

Unlike traditional banks or stock markets, DeFi projects typically don’t go through regulatory checks. That lack of oversight gives scammers more room to operate.

There are two main types of rug pulls: Liquidity Rug Pulls and Dump Rug Pulls. Let’s break these down.

1. Liquidity Rug Pull

In a liquidity rug pull, the project’s developers set up a liquidity pool on a decentralized exchange like Uniswap, PancakeSwap, or SushiSwap. A liquidity pool is what allows people to buy and sell tokens—it’s made up of two assets (usually the project’s token and a more stable one like ETH or USDT).

Here’s how the scam works:

- The developers launch a flashy new token.

- They hype it up on social media, promise high returns, and might even use fake influencers or anonymous teams to look legitimate.

- Early investors start buying the token, creating buzz and increasing its value.

- Once there’s a sizable amount of liquidity in the pool, the developers pull out all the valuable tokens (like ETH), leaving investors stuck with worthless tokens they can no longer sell.

📌 Real Example: In 2021, a token called Meerkat Finance launched on Binance Smart Chain and attracted over $30 million within a day. Then—poof—the developers disappeared, draining the funds and claiming they were “hacked.” Most people believe it was an inside job.

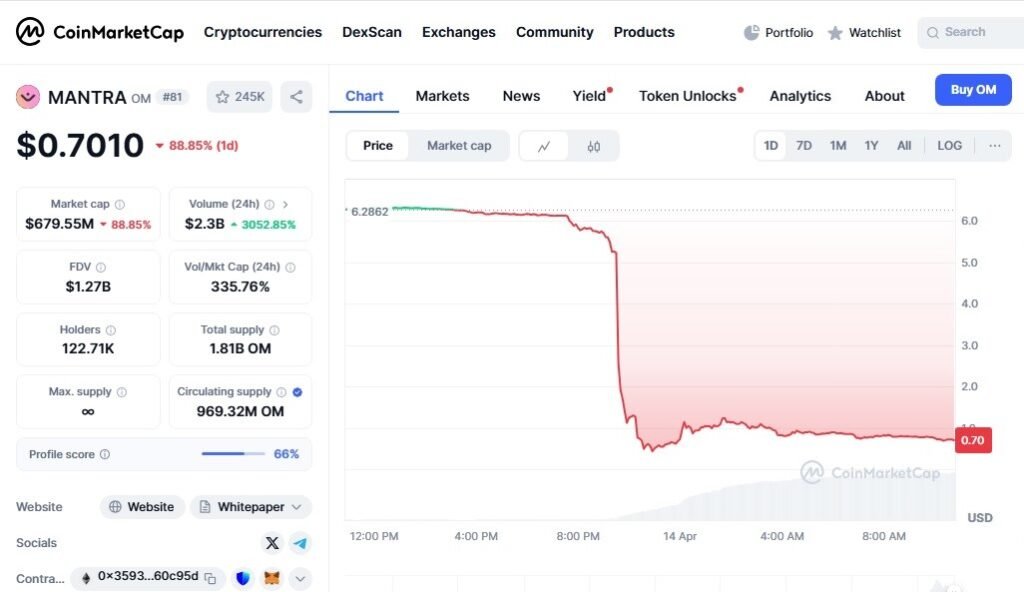

Just recently, MANTRA ($OM) plummeted from around $6.00 to $0.60 in under an hour — wiping out over $5 billion in value. While it’s not officially confirmed as a rug pull yet, the sudden crash is a stark reminder of just how volatile and risky the crypto space can be. In a market fueled by hype and speculation, even top-performing tokens can spiral without warning.

2. Dump Rug Pull

In a dump rug pull, the developers or insiders hold a massive chunk of the project’s tokens. Instead of pulling liquidity directly, they wait until the price goes up due to public interest and investor excitement. Once the price hits a peak, they sell all their tokens at once, flooding the market and causing the price to crash. Regular investors are left holding tokens that have lost 90% or more of their value.

This is sometimes referred to as a “pump-and-dump” scheme.

📌 Real Example: The infamous Squid Game Token (SQUID) pumped hard in 2021, rising from just a few cents to over $2,800 in a matter of days. But when investors tried to sell, they couldn’t—because the contract was designed to only let the creators sell. Eventually, the team cashed out, and the price dropped to nearly zero within minutes.

RELATED:

OM MANTRA Coin Crash: What Really Happened and Why Investors Should Pay Close Attention

Rug pulls often appear in projects with no real team transparency, no audit, and no real-world use case. If you’re new to crypto, always research before investing: check if the token’s liquidity is locked, look for external audits, and avoid tokens where a few wallets hold the majority of supply.

It’s a wild space—but knowing what a rug pull is and how it works can help you avoid becoming the next victim.

Major Crypto Rug Pulls List (2014-2025)

OneCoin – 2014

OneCoin was launched by Ruja Ignatova, a Bulgarian businesswoman who styled herself as the “Cryptoqueen.” The project started in 2014 and promised to be the next Bitcoin, but it didn’t even have a real blockchain.

Investors were led to believe they were buying into a revolutionary cryptocurrency, but they were actually funding a massive Ponzi scheme. OneCoin wasn’t traded on any legitimate exchange and operated by selling fake crypto education packages.

Over 3 million people worldwide, including many from Hong Kong, Canada, and Africa, invested more than $4 billion.

In 2017, just as investigators closed in, Ignatova vanished and hasn’t been seen since. Her brother, Konstantin Ignatov, was arrested in 2019 and pleaded guilty to fraud. OneCoin remains one of the largest crypto scams ever, and Ignatova is still on the FBI’s Ten Most Wanted list.

Bitconnect – 2017

Bitconnect was another infamous rug pull disguised as a lending platform. It launched in 2016 and collapsed in January 2018.

The platform promised investors 1% daily returns through a mysterious trading bot, which never existed. Investors had to buy Bitconnect Coin (BCC) to participate. At its peak, BCC reached $463 per token, making some people rich—until the rug was pulled.

Bitconnect shut down suddenly, citing government investigations. The value of BCC plummeted to nearly nothing. Authorities later revealed it was a Ponzi scheme that stole around $3.4 billion.

Founder Satish Kumbhani, from India, was indicted but disappeared. Promoters like Glenn Arcaro in the U.S. pleaded guilty. Bitconnect taught the crypto world a painful lesson about promises that sound too good to be true.

GainBitcoin – 2018

In India, brothers Amit and Vivek Bhardwaj ran GainBitcoin, claiming to offer Bitcoin mining services with high monthly returns. Starting around 2015, they attracted over 100,000 investors by offering 10% monthly returns for 18 months.

In reality, there was no mining—new investors’ funds were used to pay earlier ones. Authorities eventually arrested the Bhardwaj brothers in 2018. By then, they had taken in an estimated 600,000 Bitcoins, worth roughly $12 billion in later years. While assets were seized, much of the money vanished.

The case highlighted how early hype around Bitcoin was exploited in developing markets, especially among first-time investors unfamiliar with crypto risks.

Pincoin and iFan – 2018

Modern Tech, a Vietnamese firm, launched two fake projects: Pincoin and iFan. These were marketed as investment opportunities and a social media platform for celebrities, respectively. Investors were promised monthly returns of up to 48%, which should have been a red flag.

The company raised about $660 million from 32,000 people. They paid early investors to build trust, a classic Ponzi tactic. Then in April 2018, the team vanished, shutting down all communication. Angry victims protested in Ho Chi Minh City. The incident caused a national stir and led to Vietnam tightening its oversight on crypto investments.

Thodex – 2021

Thodex was a Turkish crypto exchange founded by Faruk Fatih Özer. It operated normally for years until April 2021, when Özer suddenly fled the country with around $2 billion in user funds.

Before vanishing, he claimed a cyberattack had forced the platform to shut down. In reality, it was a premeditated exit scam. Nearly 400,000 users, mostly Turkish citizens, were locked out of their accounts overnight.

Özer was later arrested in Albania in 2022 and extradited to Turkey. The fallout rocked Turkey’s crypto space and spurred discussions on regulating centralized exchanges.

AnubisDAO – 2021

AnubisDAO was launched in October 2021 as a DeFi project inspired by OlympusDAO. Just 20 hours after raising $60 million in Ethereum through a token sale, all funds vanished. The developers, who were anonymous, claimed a phishing attack—but blockchain sleuths quickly debunked this. It became clear the funds had been transferred to personal wallets.

The ANKH token, which had no actual utility, crashed to zero. This incident showed how easily anonymous developers can vanish with funds in unregulated DeFi spaces, especially when investors don’t audit the code or team.

Squid Game Token (SQUID) – 2021

Capitalizing on the global popularity of Netflix’s Squid Game, unknown developers launched the SQUID token in late 2021. It soared from mere cents to $2,861 in just a few days, driven by social media hype and fake news coverage.

However, investors couldn’t sell their tokens due to a hidden anti-dumping mechanism built into the smart contract. Eventually, the developers drained the liquidity pool, stealing $3.3 million, and the token crashed. Over 43,000 people, many new to crypto and fans of the show, were scammed.

The event highlighted the risks of investing in hype-driven meme tokens without reviewing the token mechanics.

SafeMoon – 2022

SafeMoon launched in early 2021 and promised passive income through a tokenomics model that included a 10% transaction fee—half distributed to holders, half added to liquidity. The project gained traction thanks to influencer promotion and meme culture.

But by 2022, it came under scrutiny. In 2023, the SEC charged SafeMoon executives, including CEO John Karony and CTO Thomas Smith, with fraud. Allegedly, they siphoned off funds and used investor money for personal luxuries like sports cars and real estate.

SafeMoon’s token price fell by over 99%, and millions of retail investors lost out. The case renewed calls for regulating crypto influencers and holding project leaders accountable.

Terra (Luna/UST) – 2022

Terra was a blockchain platform founded by Do Kwon, with UST as its algorithmic stablecoin pegged to the U.S. dollar and LUNA as its sister token. In May 2022, UST lost its $1 peg due to structural flaws in its design.

As investors rushed to exit, the system spiraled into a death loop—UST collapsed and LUNA’s value fell from over $80 to nearly nothing. The crash wiped out $40 billion in value.

Though not a rug pull in the traditional sense, many believe Kwon was reckless and misleading. He fled Singapore and was arrested in Montenegro in 2023. This crash remains one of the largest in crypto history, deeply damaging trust in algorithmic stablecoins.

Froggy (FROGGY) – 2024

Froggy was a meme coin that launched in early 2024 and quickly went viral on platforms like X and Reddit. Its price rose sharply as liquidity poured in from retail investors chasing the next big meme coin.

But within days, the anonymous developers drained the liquidity pool, causing the token’s price to drop by over 99.95%. Investors who had just jumped in were left with worthless tokens.

The team vanished without a trace. Froggy served as another reminder of the dangers of investing in unverified, anonymous tokens.

Decimated (DIO) – 2024

Decimated (DIO) was a gaming token launched by Fracture Labs in 2024. To stabilize the token launch on HTX, they partnered with Jump Trading, a high-frequency trading firm. Jump allegedly manipulated the market—pumping DIO’s price to $0.58, then dumping it down to under a cent before buying back in.

Fracture Labs accused them of deliberate manipulation and filed a lawsuit. The token’s value tanked, and the case stirred debate about how large firms can manipulate even supposedly decentralized ecosystems. Many investors, particularly gamers, felt betrayed by what they thought was a genuine Web3 gaming project.

Why You Must Be Proactive

Crypto Rug pulls are not rare—according to multiple blockchain analytics firms, millions of dollars are lost monthly to such schemes. And once it happens, there’s no refund button.

That’s why this checklist matters.

A Beginner’s Checklist to Avoid Crypto Rug Pulls

1. Check If the Project’s Liquidity Is Locked

- Why It Matters: Unlocked liquidity means developers can withdraw it at any time.

- How to Check: Use platforms like Unicrypt or Team Finance to verify if liquidity is locked and for how long.

- Green Flag: Locked liquidity for at least 6 months.

- Red Flag: No information about liquidity or it’s unlocked.

2. Verify the Team’s Identity

- Why It Matters: Anonymous or pseudonymous teams are common in rug pulls.

- What to Look For:

- Public LinkedIn profiles

- Verified Twitter accounts

- Appearances in interviews, podcasts, or YouTube

- Green Flag: Team members have a proven track record or are doxxed (public identities).

- Red Flag: No traceable info or stock profile pictures.

Note: Some anonymous founders are legit (like Bitcoin’s Satoshi), but for beginners—trust real names.

3. Study the Tokenomics

- Why It Matters: Tokenomics reveals how the coin is structured and distributed.

- Checklist:

- Is the supply capped?

- How much is allocated to the team?

- Is there a vesting schedule?

- Any whale wallets holding too much?

- Red Flag: 30–50% of tokens controlled by one wallet or team.

- Green Flag: Transparent, audited token allocation with vesting for insiders.

4. Read the Smart Contract Audit (If Available)

- Why It Matters: Audits review code for bugs or malicious functions.

- How to Check:

- Look for audits from reputable firms like CertiK, Hacken, or PeckShield.

- Read audit summaries for mentions of backdoors or “minting functions” (where unlimited tokens can be created).

- Green Flag: Recent audit by a respected third party.

- Red Flag: No audit, or audit from a no-name company with a generic PDF.

5. Use Blockchain Explorers to Check Holders

- Why It Matters: A decentralized token should have a healthy distribution.

- How to Check:

- Use Etherscan or BscScan (depending on the chain).

- View the “Holders” tab to check how many wallets hold the token.

- Red Flag: One or two wallets holding 70% or more.

- Green Flag: Distributed ownership across hundreds or thousands of wallets.

6. Evaluate the Community Activity

- Why It Matters: Real communities grow organically. Fake ones are often bought.

- How to Check:

- Join the project’s Discord or Telegram.

- Look for authentic discussions, real questions, and developer engagement.

- Watch out for bots, spam, and admins banning anyone who asks hard questions.

- Green Flag: Transparent, responsive, helpful community.

- Red Flag: Hype-heavy chats, no technical discussions, instant banning of critics.

7. Check for Red Flags in the Whitepaper

- Why It Matters: Many rug pulls use vague or plagiarized whitepapers.

- Checklist:

- Is the roadmap clear and achievable?

- Does the use case make sense?

- Any claims of guaranteed returns? (That’s illegal in many jurisdictions)

- Green Flag: Detailed, realistic whitepaper with references and measurable goals.

- Red Flag: Buzzword soup with zero depth.

8. Analyze Social Media and Web Presence

- Why It Matters: A professional, consistent online presence signals effort and planning.

- Checklist:

- Is the website secure (https://)?

- Is there a clear contact page, not just a form?

- Is the domain new and sketchy?

Use tools like Whois Lookup to check when the site was created.

- Red Flag: Brand-new site, no contact info, or frequent changes in whitepaper.

- Green Flag: Clear branding, transparency, and consistency across channels.

9. Watch for “Too Good to Be True” Hype

- Why It Matters: Rug pulls often bait beginners with massive return promises.

- Examples:

- “100x guaranteed”

- “Pre-sale ending in 2 hours!”

- “Early investors already made 5x!”

- Green Flag: Cautious language, focus on development, not wild promises.

- Red Flag: Shillers everywhere, overly aggressive marketing.

10. Avoid FOMO-Driven Pre-Sales

- Why It Matters: Many rug pulls happen during pre-sales when liquidity hasn’t been added yet.

- Checklist:

- Is the pre-sale audited?

- Is the smart contract visible and verified?

- Is there a vesting schedule for early buyers?

- Green Flag: Clear lock-up rules, audited contracts, public token metrics.

- Red Flag: No smart contract preview, unrealistic hard caps, or “send funds to this wallet” setups.

11. Follow the Money Trail

Use free tools like:

- TokenSniffer

- Dextools.io

- Bubblemaps

- Coinmarketcap

These tools can help you:

- Detect honeypots

- Find hidden developer wallets

- Visualize suspicious token movements

12. Stick to Reputable Exchanges and DEXs

- Avoid unknown platforms. Use well-known centralized exchanges like Binance, Coinbase, or Kraken, or decentralized ones like Uniswap or PancakeSwap (with care).

- Many rug pulls happen on obscure or cloned exchanges.

Bonus: Trust Your Gut—but Back It with Data

If something feels off, it probably is. But don’t base decisions purely on instinct. Validate your doubts using tools and data. When in doubt, don’t invest.

Final Thoughts on Crypto Rug Pulls

Crypto Rug pulls exploit lack of research. In a decentralized world, you are your own bank—and your own regulator. That means you must ask the hard questions before putting your money into any project.

Use this checklist each time you evaluate a new token. Print it, bookmark it, revisit it.

Crypto offers real opportunity—but without vigilance, it can also become a minefield. Stay informed, stay skeptical, and protect your portfolio.

FURTHER READING:

What to Do When Crypto Market Crashes (Like MANTRA Just Did): 10 Survival Guidelines

OM MANTRA Coin Crash: What Really Happened and Why Investors Should Pay Close Attention

SB1797: Illinois Moves to Regulate Crypto and Protect Consumers with New Digital Assets Bill