The cryptocurrency space is no stranger to sudden collapses, but few events shake retail investors like a sharp nosedive in token price with unclear cause. Over the past 24 hours, MANTRA’s native token OM has done just that — crashing nearly 92%, wiping out over $5.5 billion in market cap, and igniting a storm of speculation, fear, and anger.

In this comprehensive analysis, we’ll break down what happened, what we know so far, who’s being blamed, and — most importantly — what it means for the average crypto investor. If you’re new to crypto, buckle up. This is both a cautionary tale and a deep dive into how things can go terribly wrong, even on reputable platforms like Binance.

Table of Contents

What is a MANTRA Token?

Before diving into the drama, let’s understand what OM MANTRA coin is supposed to be.

MANTRA is not just another altcoin. It’s a Layer 1 blockchain focused on the tokenization of real-world assets (RWAs) — things like real estate, bonds, and even debt instruments. Their vision was grand: bridge traditional finance (TradFi) with decentralized finance (DeFi), offering compliant tools for staking, DeFi lending, and KYC/AML integrations.

Think of it as a hybrid between Wall Street and Web3, with OM as the utility token powering the network. In theory, OM holders could earn yield, participate in governance, and access tokenized financial products.

But theory is one thing. Execution, as the last few days have shown, is another.

How many MANTRA coins are there? According to CoinMarketCap, the total supply of OM tokens is 1.81B OM tokens. Total supply = Total coins created – coins that have been burned (if any) It is comparable to outstanding shares in the stock market.

However, the maximum supply of OM tokens is infinity. The maximum amount of coins that will ever exist in the lifetime of the cryptocurrency. It is analogous to the fully diluted shares in the stock market.

The OM MANTRA Coin Crash: Key Numbers

| Metric | Value |

|---|---|

| Previous OM Price | $6.30 |

| Current Price | $0.5010 |

| 24-Hour Drop | ▼ 92.00% |

| Market Cap Loss | $5.5 Billion |

| Volume Surge | ▲ 744.98% |

While the broader crypto market barely moved (+0.33% in volume), OM exploded in trading activity — and not in a good way.

This kind of volatility is unusual even for meme coins, let alone a project claiming serious institutional-grade goals.

What Happened to Mantra Coin?

OM MANTRA token tanked hard on April 13, 2025, dropping over 90% in just hours—from around $6 to under $0.50. It wiped out billions in value, shocking investors.

The team says it wasn’t their fault, blaming “forced liquidations” on exchanges during low-trading hours, which triggered a selling frenzy.

Some folks think the team might’ve dumped their tokens, since they reportedly hold a big chunk of the supply, but they deny it. There’s also talk of shady exchange moves or insider selling, but nothing’s proven yet. The token’s recovered a bit, hovering around $1, but trust is shaky, and people are comparing it to past crypto crashes like Luna.

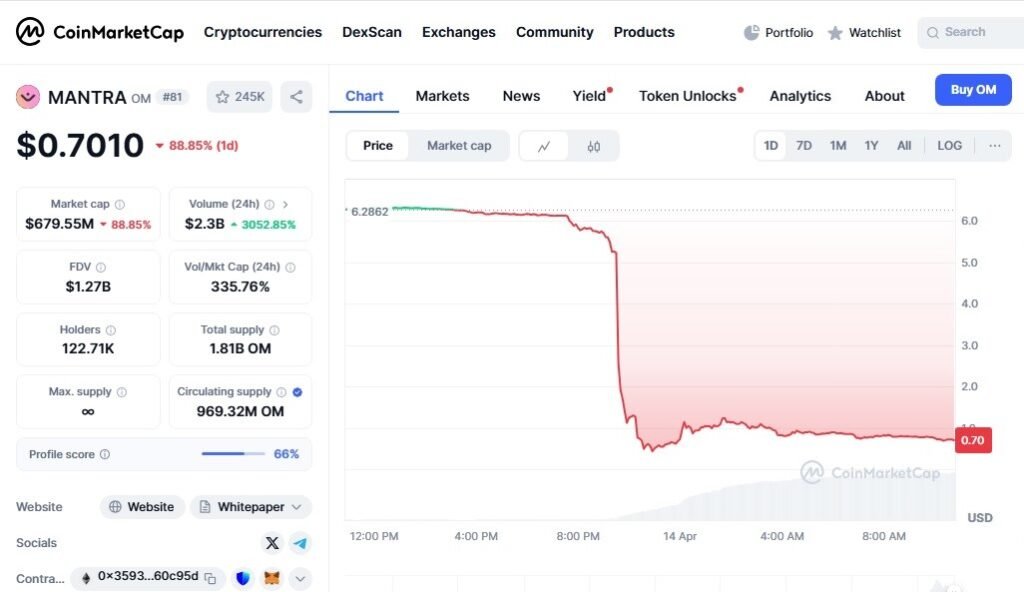

What is the price of mantra coin? Well, by the time of writing this article, Mantra’s OM token was hovering around $0.70710 reflecting 88.85% dip in 24 hours.

Mantra price chart shows a steep drop in less than 1 hour, translating to more than 90% loss at that time. What happened to Mantra coin? Keep reading.

MANTRA (OM) experienced a sharp and unsettling drop in price, closing at $0.7073, which marks a steep 90% decline in just 24 hours. This kind of drop is significant, especially for newer investors, and often reflects panic selling or a sudden shift in market sentiment.

Earlier in the session, the price quickly plunged to a low of $0.6734 from a high of $6.2, showing extreme volatility. This big swing — an amplitude of over 90% — suggests that traders were reacting to news or events that triggered fear and uncertainty.

Strong Downward Trend

The current price is far below key moving averages:

- MA(7): $4.8295

- MA(25): $5.9226

- MA(99): $5.8486

These long-term indicators confirm that OM is in a strong bearish trend, with no clear support level close by. For beginners, this means that the price is trending down and shows no signs of bouncing back just yet.

Volume Spikes Confirm Selling Pressure

- Trading volume: 200 million OM

- USDT volume: Nearly $168 million

Such high trading activity during a price drop is often a sign of capitulation — a point where many investors give up and sell, often at a loss. This could also mean that some traders were forced to sell, possibly due to margin calls or automatic liquidations.

Sentiment: Fear is Driving the Market

The sharp fall and sudden sell-off suggest that investor sentiment is dominated by fear. Whether triggered by broader market conditions or specific insider activity, the market is currently very fragile.

Key Technical Indicators

- RSI: Likely in oversold territory (below 30), which might signal that the price is due for a short-term bounce.

- MACD: Likely showing a wide bearish spread — price is far below all moving averages, confirming strong downward momentum.

Watch for a MACD crossover (when the MACD line moves above the signal line) or RSI divergence (price falls while RSI starts rising), which could signal a shift in momentum.

Support and Resistance to Watch

- Immediate Support: $0.6734 (today’s low) — a breakdown below this could push price closer to $0.50, a psychological level.

- Resistance Levels: $0.7073 (today’s close), followed by $1.0090 (previous open). A move above these levels could indicate recovery.

Short-Term Outlook: Caution Advised

The market is clearly in a downtrend. If you’re thinking of trading, this is not the time to chase quick gains. Beginners especially should be cautious and avoid “catching a falling knife” — a term used when traders buy during a crash hoping it will rebound, only to see prices fall further.

What Triggered the Crash?

Let’s walk through the official explanation, the community response, and what on-chain data reveals.

✅ Binance’s Position: Cross-Exchange Liquidations

Binance, one of the world’s largest crypto exchanges, was quick to publish a statement:

“Our initial findings indicate that the developments over the past day are a result of cross-exchange liquidations.”

Binance claimed that since October, it had reduced OM’s leverage exposure and issued tokenomics warnings to users on the spot trading page. They’ve now updated their risk warning for OM, classifying it as highly volatile.

In simpler terms: Binance says it saw this coming and tried to warn people.

But critics argue the measures came too late, and that retail investors were caught completely off-guard.

⚠️ Forced Liquidations: Blame the Exchanges?

John Patrick Mullin, co-founder of MANTRA, was among the first to speak out:

“The OM market movements were triggered by reckless forced closures initiated by centralized exchanges on OM account holders.”

According to Mullin, massive leveraged positions were liquidated suddenly — particularly during low-liquidity trading hours (Sunday evening UTC). This kind of mass liquidation often creates cascading sell-offs, driving prices down fast and hard.

But is that the whole truth?

🧨 Rumors and Community Theories: Exit Scam or Negligence?

Let’s summarize the major accusations circulating among traders:

- Team Resignation Rumors: Whispers began that the core Kabal team behind OM resigned right before the crash.

- Massive Sell-Off: Over $590 million worth of OM was sent to exchanges — likely team or insider wallets.

- Airdrop Mismanagement: Some users claim OM changed airdrop vesting terms multiple times, stalling unlocks while insiders positioned for exit.

- DAO Vote Manipulation: Allegations that OM used fake wallets to pass key governance votes.

- Bridge Exploits & Liquidity Traps: Accusations that users were forced to bridge to MANTRA Chain, only for insiders to dump post-bridge hype.

- 3.9M OM Sent to OKX: One large transfer triggered a panic, followed by broad sell-offs.

There’s also the nuclear claim: that this was a coordinated rug pull, comparable to Terra/LUNA’s 2022 collapse.

Some users even accused Mullin of trying to launder funds by selling OM for ETH and routing it through multiple wallets.

According to one user on CoinMarketCap, OM trading has apparently stopped on many exchanges, and users are being told to use decentralized exchanges (DEXs) if they want to exit their positions.

Was It an Exit Scam?

We cannot confirm that definitively.

However, there are red flags:

- Lack of transparency around team holdings.

- Sudden token transfers to centralized exchanges.

- Poor communication to retail holders until after the crash.

- Frequent changes to tokenomics and vesting schedules.

All of these create an atmosphere of distrust, regardless of whether any laws were broken.

Read Our Crypto Survival Guide: What to Do When the Market Crashes

What Binance Did (And Didn’t) Do

Binance claims it had implemented safeguards:

- Reduced leverage exposure on OM (since October).

- Added risk pop-up warnings on OM’s spot page (since January).

- Upgraded volatility warnings after the recent crash.

But critics argue Binance failed to protect users when it mattered most. Liquidations were allowed to proceed during low-volume trading windows — creating a perfect storm.

Even if Binance didn’t directly cause the crash, its algorithms and margin liquidation systems may have amplified it.

Lessons for Retail Crypto Investors

If you’re new to crypto, this may all seem overwhelming. So let’s break down the takeaways you need to remember.

1. Centralized Exchanges Can Trigger Chaos

Forced liquidations can wipe out leveraged positions without warning. Even responsible investors can get caught in the fallout.

2. Always Check Token Supply and Ownership

Projects where the team holds 70-90% of the supply should raise alarms. That’s centralization, not DeFi.

3. Read the Tokenomics and Vesting Schedules

If a project keeps changing its vesting rules, it may be setting up for a rug pull.

4. Don’t Trust, Verify

Influencers, podcasts, and crypto channels often get paid to shill tokens. Always DYOR (Do Your Own Research).

5. Airdrops Are Not Free Money

Some airdrops are structured as traps — designed to build hype, but manipulated from the inside.

6. If It Crashes, It’s Often Too Late

By the time a project drops 50%, your chance to exit is mostly gone. Don’t “wait and hope.” Set stop-losses. Diversify. Use risk management.

So, What Happens Next for OM?

Will the Mantra coin go up? It’s unpredictable if Mantra (OM) coin will recover this crash. The fall was massive. But recovery can’t be ruled out.

What is the future prediction of OM coin?

The reputation damage is enormous.

Even if OM survives technically — through forks, new leadership, or rebranding — the trust is broken. Investors, both retail and institutional, are unlikely to return in droves.

Some predictions:

- Binance may delist OM entirely if the situation escalates.

- Regulators could get involved, especially if retail users allege fraud.

- Class-action lawsuits may emerge, depending on jurisdiction.

- Developers may abandon the project, unwilling to rebuild trust.

Final Thoughts: A Sobering Reminder

Crypto is revolutionary, but it’s also a breeding ground for greed, manipulation, and poor oversight. What happened to OM MANTRA coin is more than just a price crash — it’s a case study in what can go wrong when centralization, opacity, and hype collide.

If you’re an investor, be careful.

If you’re a builder, be transparent.

And for crypto exchange platforms such as Binance, the crypto community expects accountability, not just statements.

Further Reading:

MANTRA Token Price Crashes 92% in a Day: What Now?

Helium Token Price Surges 30% in a Day—What’s Going On?

How to Earn Commissions with the Binance News Bot in 3 Simple Steps